What exactly is a precious metals depository, and how does it work? What is their role and when do you even use them?

If you’re buying gold with retirement funds, your IRA custodian takes care of storage for you and places your metals in an IRS-approved depository. If you are buying bullion with non-retirement funds, a precious metals depository is an option you can use to store your gold or silver securely.

Discover the different types of storage, how to choose a depository, and how to compare them to alternatives like bank safe deposit boxes.

What is a precious metals depository?

A depository is a secure storage facility for physical precious metals like gold, silver, and platinum. These are independent companies that focus exclusively on precious metals storage, and they’re separate organizations from your gold dealer or self-directed IRA custodian.

Depository facilities are highly secure and include insurance coverage to protect your precious metals from theft or natural disasters.

Other roles of a metals depository

Besides storing your metals, these companies provide other services like:

Transactions: They take care of buying, selling, and transferring precious metals between different accounts.

Management: Precious metals depositories have systems for managing stored metals inventory and reporting.

Authentication and testing: A third-party storage facility can also authenticate and test precious metals to guarantee their quality and authenticity.

Collateral: Some investors use their gold, silver, platinum, and palladium bullion as collateral for loans. In these situations, the lender requires a secure storage facility to hold the metals.

When do you use a depository?

If you buy gold with some of your 401(k) rollover or an IRA, your custodian automatically deposits the metals in an IRS-approved depository. You aren’t really involved in this decision since it’s part of the custodian’s responsibility to manage your account. This also falls under IRS tax rules since you can’t physically possess your precious metals until you reach retirement age.

In cases where you buy precious metal assets with non-retirement funds, you can store your gold, silver, and platinum wherever you want. Some investors might go with bank safe deposit boxes, and others might decide to work with bullion depositories.

How a precious metal depository works

If you are looking to use a precious metals depository outside of your retirement account, here is how it works:

Open an account

Research companies and open an account. You’ll submit an application with your account details, proof of identification, and choice of depository location if the company offers different options.

Deposit your metals

Once you have an account, you’ll set up delivery through your precious metals dealer or ship the metals on your own. Make sure you ship all of your precious metals with insurance coverage.

Security measures

All IRS-approved depositories have these security capabilities:

24/7 surveillance and monitoring systems

Advanced alarm systems

Restricted access controls, often including biometric scanners

Secure, fortified vaults

Armed security personnel

Regular audits and inventory checks

Compliance with IRS regulations for precious metals storage

Climate-controlled environments to protect metals

Strict protocols for handling and transporting precious metals

Withdrawing your metals

In the future, when you want to withdraw your metals, you’ll contact your depository or IRA custodian. If you have a personal account, you can reach out to the depository directly. For IRA-held metals, you’ll need to work through your IRA custodian. Be aware that if you take physical possession before you reach age 59 1/2, you’ll have to pay penalties and taxes.

The next step includes completing withdrawal forms and listing the amount and type of metals you’d like to withdraw. You have a couple of options to remove your metals:

In-kind distribution: This is where you receive the physical precious metals. The depository securely ships your metals to your chosen address or you might be able to pick up the metals in person.

Cash distribution: With this option, you sell the metals for cash.

IRS-approved precious metals depositories

Some of the depositories that store metals for your precious metals IRA include companies like:

Delaware Depository

Located in Wilmington, Delaware, Delaware Depository has been in business since 1999. It provides secure precious metals storage for a variety of clients.

Key features

Trusted exchange: CME Group uses Delaware Depository as a delivery point for physical settlements of gold, silver, platinum, and palladium traded on the COMEX and NYMEX.

Regulatory compliance: This depository has SEC authorization to work directly with mutual funds and other institutional investors regulated under the Investment Company Act of 1940.

Asset protection: $1 billion “all-risk” insurance coverage through Lloyd’s of London to protect your precious metals against a wide range of potential losses and up to a very high total value.

Reddit users in r/Gold share their experience with different depositories, and user LetRoutine8851 noted:

“Delaware Depository is a trust company qualified to store bullion held in IRA under the Internal Revenue Code. Also, it’s insured against theft by Lloyd’s of London. Don’t know about the other depositories; do your due diligence, especially with retirement assets!”

Brink’s Global Services

Brink’s is a household name that’s been in the security business for over 160 years. They provide top-level protection for precious metals and meet IRS regulations for precious metals IRAs.

Key features

Segregated storage options: You can choose segregated storage, which keeps your precious metals separate from others.

Global network: Brinks provides international depository services through its worldwide network of secure vaults.

International Depository Services (IDS)

With locations in Delaware and Texas, IDS provides strong security, insurance, and high levels of customer support.

Key features

No-cost segregated storage: Most precious metals depositories charge for segregated storage, but International Depository Services Group offers this capability at no cost.

Reporting: IDS offers a proprietary online portal that provides real-time holdings management and reporting.

Dakota Depository Company

Located in North Dakota, Dakota Depository offers secure IRS-compliant storage. It’s known for its focus on client confidentiality and safety.

Key features

Location: The company’s facility in Fargo, North Dakota, provides secure storage in an area with fewer natural disasters.

Security: Military-grade vault from the same construction used in Air Force installations. Security personnel supported by U.S. military-trained leadership.

Advantages of using a depository

If you want to buy precious metals outside of a retirement account and you’re trying to decide if you should use a precious metals depository, here are key advantages:

Security measures

High-level security systems in depositories provide maximum protection for your metals. They provide robust security measures like 24/7 surveillance and advanced entry systems like biometric scanners. Armed guards make sure that only authorized people can access the vaults to protect the safety of precious metals stored.

Insurance protection

Most depositories offer insurance policies that cover the full value of your stored precious metals. This insurance protects against possible losses due to theft, damage, or natural disasters.

Regulatory oversight

The government regulates these precious metals depositories which means they have to go through regular audits to keep their certifications. Some, like Delaware Depository, are state-chartered trust companies that provide additional oversight.

Disadvantages of using a depository

Storing precious metals in a depository has its benefits, but there are also a few drawbacks to consider:

Fees

Depositories charge a fee for storing your metals, which can add up over time. The security and insurance may be worth the cost, but you should consider this ongoing expense. The types of service fees you might see include:

Storage fee: Your depository might charge between 0.3% and 0.95% of the metal’s total value per year. Some precious metals depositories use tiered pricing for storage fees, depending on the value of the metals stored.

Insurance: Many depositories include insurance coverage in their storage fees.

Segregated vs. non-segregated storage: Most depositories charge extra for segregated storage.

Additional costs: You might have other fees like account setup, transactions, wire transfers, or account termination.

Less control

If you use home storage, you have complete control over your metals. But, if you are looking at storing bullion in a third-party facility, you give up things like:

Access: You’ll have limited access to your stored assets. There may be restrictions on viewing or retrieving your physical assets.

Third-party reliance: You keep your assets with a third party, which means you’ll need a high level of trust in their security and management practices.

Privacy concerns: Some investors want to keep their precious metals assets private, which isn’t an option with depositories that keep records of your holdings.

Types of storage options

Investors can choose between different storage types:

Segregated storage

In segregated storage, each client’s precious metals are stored separately in dedicated compartments. This option provides the highest level of assurance and security regarding ownership.

Allocated storage

In allocated storage, clients store their metals alongside those of others, but the facility accounts for each client’s metals individually. While clients receive the same type of metal upon withdrawal, they may not receive the exact pieces they deposited. This method is less expensive than segregated storage.

Here’s a comparison of key features to help you see the differences in storage types quickly:

| Storage type | Ownership clarity | Typical cost | Best for |

|---|---|---|---|

| Segregated storage | Investors who want the exact asset identity | Higher (premium for dedicated space) | Investors who want exact asset identity |

| Allocated storage | Metals stored with others but tracked to your account | Moderate (lower than fully segregated) | Cost-conscious investors seeking secure storage |

Considerations when choosing a depository

Here are the factors that you need to consider when choosing a depository:

1. Security practices

The primary concern you should have is security. Make sure that the facility has strong protection like secure vaults, advanced surveillance systems, alarm mechanisms, and strict access controls.

2. Insurance coverage

Depositories should provide full insurance coverage that protects your metals against theft, loss, or damage. This coverage protects your investment even in rare circumstances where something bad can happen.

3. Climate-controlled environment

Precious metals can be affected by environmental factors like humidity and temperature. A reputable depository should keep a controlled environment to prevent degradation so that your metals retain their quality over time.

4. Regular audits

For the highest transparency and standards, look for a depository that does thorough routine audits. These audits verify the accuracy of records, confirm the physical presence of your assets, and assure proper management practices so that you’ll know that your metals are well cared for.

5. Convenient location

You should consider how close the depository is to where you live — especially if you want to occasionally check on your assets in person. Many depositories offer appointments so you can view your precious metals, and the closer you are, the easier it is to set this up.

6. Privacy and confidentiality

Make sure the depository has processes for protecting your personal information and keeping the details of your holdings confidential.

7. Fees

Depositories charge fees for storage and maintenance. These costs can vary, so review and compare pricing structures to find one that aligns with your financial plans and investment goals.

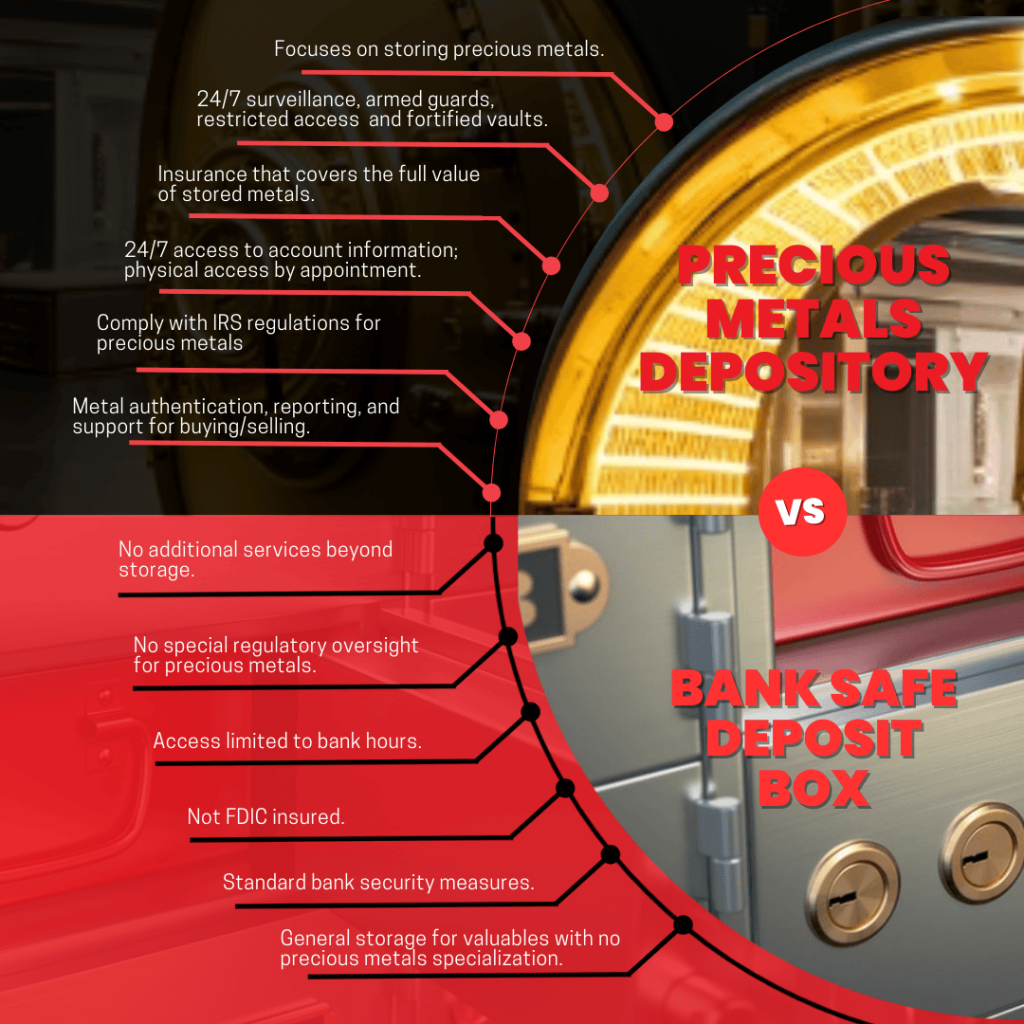

Depository vs bank safe deposit box

You can consider other third-party storage facilities, like storing your metals at a bank safe deposit box, but there are some key differences to consider:

Specialization: Depositories focus specifically on precious metals storage. Banks provide general-purpose storage for valuables.

Security: A precious metals depository has more advanced security measures like 24/7 surveillance, armed guards, and restricted access. Banks do not have this same level of security.

Insurance: Depositories have comprehensive insurance coverage for stored metals, while banks do not offer insurance for your metals, and they aren’t insured by the FDIC.

Accessibility: Some precious metals depositories offer remote management and 24/7 access to account information. Banks do not offer any account information, and your access is limited to bank hours.

Regulatory oversight: Specialized depositories must follow IRS compliance and regulations, but banks do not have this level of regulation for precious metal storage.

Management: Precious metals depositories provide specialized handling and inventory management, while banks offer self-managed storage.

Additional services: Your depository might provide services like assaying, reporting, and supporting purchases and sales. Banks do not offer additional services beyond storage facilities.

Working with a precious metals dealer

Your precious metals dealer can also provide recommendations on depositories that best fit your situation. The Swiss America team has supported thousands of investors through the buying process. We’re focused on education and resources to help you make investment decisions and safely buy gold or other precious metals.

You can learn more about investing in precious metals through our free resources like:

Videos and podcasts: Stay updated on economic news and gain insights into the factors affecting precious metals investments through our regular podcasts and YouTube videos.

Research reports: Our team produces detailed research reports on topics like The Secret War on Cash and The Timeless Truth of Gold & Silver.

Daily news: Learn about the latest global events and their impact on gold and precious metals investments through our newsletter.

Precious metals depositories

Precious metal depositories provide secure storage for gold, silver, and other valuable metals. While they do charge fees and limit direct access, they provide protection and peace of mind for many investors. Consider your needs, research options, and compare costs to decide on how you want to handle precious metals storage.

To learn more about a precious metals IRA or investing in gold, silver, or platinum, contact the Swiss America team today!

Precious metals depository: FAQs

What states have a gold depository?

Kentucky and Texas have government-run gold depositories. Kentucky is home to Fort Knox, which is actually the United States bullion depository. Texas has the state-run Texas Precious Metals Depository.

What is the largest gold depository in the world?

The largest is the Federal Federal Reserve Bank of New York’s gold vault. As of 2024, the vault has 507,000 gold bars of which 98% belong to central banks of foreign governments and the rest belong to the United States and international organizations like the IMF.

How much does it cost to store gold in a depository?

The cost depends on the value of your metals but you can estimate between .3% to 0.95% of the metal’s value per year.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.