Looking to add gold to your retirement savings? A Gold Roth IRA could be a great option to diversify and protect your wealth. Gold has a proven history of performing well during periods of inflation and market uncertainty, which is why many investors want to add it to their retirement savings.

Gold is a scarce resource with inherent value that can help protect your portfolio during economic downturns. This article will explain how to invest in Gold Roth IRA, the benefits of adding gold to your retirement account, and how to get started.

Understanding Gold Roth IRA

A Gold Roth IRA is a retirement account that combines the tax-free growth and withdrawals of a Roth IRA with the ability to invest in physical gold and other precious metals. It allows you to hold gold, silver, platinum, and palladium coins or bars that meet IRS purity standards.

It offers more diversification than traditional Roth IRAs, which focus on stocks or mutual funds.

Key features of a Gold Roth IRA

Tax-free growth

A Gold Roth IRA gives you tax-free growth, and the IRS doesn’t tax any earnings from your gold and precious metals as they accumulate. You can withdraw your contributions at any time with no taxes since you already paid taxes on this money.

Then, you can make tax-free qualified withdrawals in retirement after age 59½ if you’ve had the account for at least five years.

This can be an advantage over a traditional IRA, where you’ll pay income taxes when you withdraw. Check with your tax or financial advisor to learn more about the tax advantages of a Roth vs traditional IRA for your situation.

Self-directed

A Gold Roth IRA is a self-directed account that gives you full control over your investments. The way these accounts work is that you’ll choose an IRA custodian who manages the account on your behalf. Meanwhile, you decide what to buy and direct the custodian to make purchases or sell when you’re ready.

Precious metal investment

A Gold Roth IRA allows you to invest in tangible metal assets like gold, silver, platinum, and palladium. The IRS sets rules around which metals qualify. The goal of these requirements is to protect investors from scams or low-quality investments.

Both your custodian and your precious metals dealer can provide insight into which coins or bars you can buy inside your Roth Gold IRA.

To make this easier to understand, here’s a table of metals that meet IRS requirements:

| Metal type | Minimum IRS purity | Forms allowed | Examples |

|---|---|---|---|

| Gold | 99.5% | Coins & Bars | American Gold Eagle, Canadian Maple Leaf |

| Silver | 99.9% | Coins & Bars | Silver American Eagle |

| Platinum | 99.95% | Coins & Bars | Platinum American Eagle |

| Palladium | 99.95% | Coins & Bars | Palladium coins/bars |

Steps to invest in Gold Roth IRA

Here are the key steps to help you set up and manage your Gold Roth IRA:

Step 1: Choose an IRA custodian

The first step is opening a self-directed Roth IRA account. You’ll start by picking a custodian to manage your money. Shop around and look at their fees and reviews to make the best choice for your specific needs. You can check with the IRS website to make sure they have a license and offer precious metal IRA services.

If you don’t have a custodian in mind, the Swiss America team can recommend one based on our many years of experience helping investors set up their Gold Roth IRAs.

Step 2: Fund your account

Once you’ve selected a custodian, it’s time to fund your Gold Roth IRA. You can do this through a direct contribution or by rolling over funds from an existing retirement account such as a 401(k), TSP, 403(b), or existing IRA.

If you’re rolling over funds, go with a direct rollover if possible. It’s easier and reduces your risk of accidentally missing IRS deadlines.

If you’re setting up a new account, Roth IRAs have annual contribution limits. For 2026, you can add $7,500 if you’re under 50 and $8,600 if you’re over 50.

Step 3: Find a reputable precious metals dealer

Your Gold IRA custodian buys physical gold bullion and other metals but they don’t actually sell it. To decide which metals you want to add, work with a reputable precious metals dealer like Swiss America.

The best companies for your Gold IRA account have excellent reviews and provide resources to help you make investment decisions.

Step 4: Purchase gold

Now, you can start buying gold. As we mentioned above, the IRS has specific purity and other requirements for metals in Roth Gold IRAs. A few general guidelines include:

Metal types: Gold, silver, platinum, and palladium.

Forms: Pure bullion gold coins or bars. Note that the IRS doesn’t allow you to buy collectible coins.

Brands: You can buy Gold American Eagle and Canadian Maple Leaf Coins or bars from manufacturers like PAMPE Suisse and Royal Canadian Mint.

Step 5: Store gold securely

Once you buy metals, your dealer sends them directly to your Gold IRA custodian. They’ll take care of storing your metals in an IRA-approved depository. This third-party location keeps your metals secure until you can take physical possession at retirement age.

This is an IRS requirement because if you directly hold precious metals, the government considers this a distribution, which creates a taxable event.

Pros and cons of investing in Gold Roth IRA

Is a Gold Roth IRA right for you? Here’s the advantages and drawbacks to consider for your retirement savings:

Pros

Diversification

Precious metals have their own value and are independent of the stock market. Many investors hold physical gold to diversify their savings and reduce some risk.

The interesting thing about gold is that whenever there’s a crisis, chaos, or general uncertainty, investors rush to buy it. This creates a “safe-haven” asset effect because it’s a way to protect your money from these market ups and downs.

We saw this during the COVID-19 pandemic and again right now as more countries add gold to their reserves. No one knows what the future might bring, and investors look at gold as an “insurance policy” to protect their money for the long term.

Tax benefits

A Roth IRA offers tax-free growth and withdrawals in retirement. Investors use this option for reasons like:

Tax-free withdrawals in retirement: We covered this benefit, which can be an advantage if you think you’ll be in a higher tax bracket at retirement age.

No minimum required distributions: With traditional IRAs, the IRS sets requirements on regular withdrawals that you must make in retirement. With Roth IRAs, you don’t have these requirements, so you can leave the money in your account as long as you’d like.

Flexibility for early withdrawals: In other scenarios where you want to make withdrawals before retirement age, you can take out your contributions without penalty since you have already paid taxes on them.

Estate planning: Roth IRAs let you pass on your savings to your heirs tax-free, which might benefit your overall estate plans.

Long-term stability

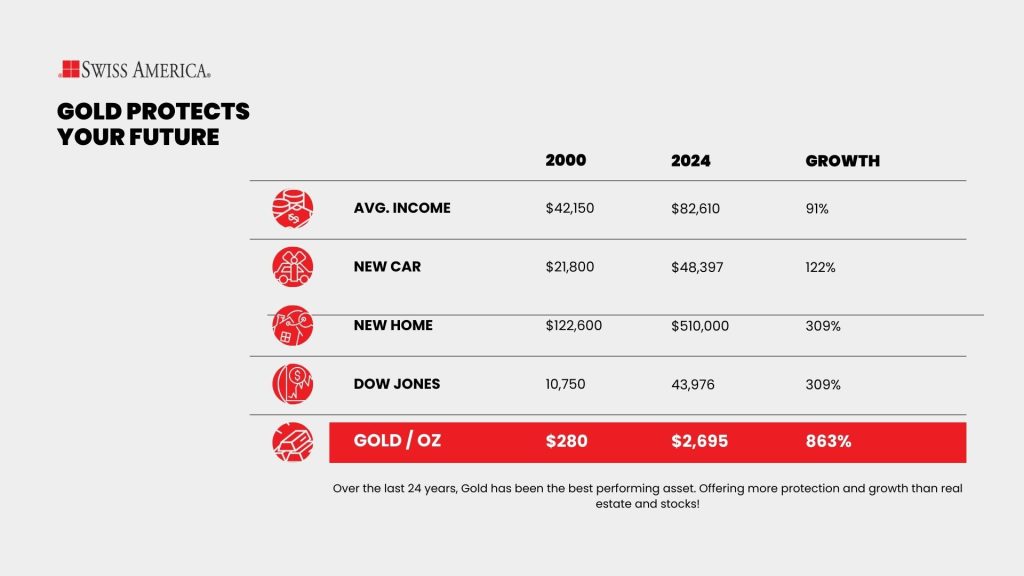

Gold has a proven track record of maintaining its value during periods of economic uncertainty, inflation, and market instability. Policy changes or market crashes impact paper currencies and stocks, but gold retains its purchasing power over time.

For example, during the 1970s, when we had high inflation, or during the 2008 financial crisis, gold prices rose while other assets declined. Holding gold in a Roth IRA can help protect your retirement savings from future risks while also offering long-term value growth.

Check out our chart comparing inflation to gold’s value:

Cons

Storage fees

Since the IRS requires your custodian store your metals in an IRS-approved depository until you reach retirement, there are storage fees to consider. Depending on the size of your holdings and your custodian fees, this amount can range from a few hundred to a few thousand dollars annually.

Be aware of these costs upfront and factor them into your investment strategy and potential returns.

No income

Gold investments within a Roth IRA do not generate income like stocks or bonds. Most investors that buy physical precious metals consider these to be like insurance since they can protect your wealth. Still, you’ll need to consider the impact of a non-income-generating asset on your overall retirement funds.

Gold IRA companies

If you want to move forward with a gold individual retirement account for your savings, be sure to work with a reputable gold dealer in this process. A trusted dealer like Swiss America offers several advantages:

Reliability

Swiss America has been assisting investors through market fluctuations since the early 1980s. Our long history means you’ll get access to high-quality metals for your retirement accounts.

Client satisfaction

Thousands of clients trust us for fast delivery of their metals, responsive customer service, and ongoing support.

Expert support

Our team can provide expert guidance on managing precious metals IRAs, diversifying your portfolio, and understanding market trends. We’re committed to providing resources to help you make the decisions for your retirement accounts.

Gold Roth IRA

Investing in a Gold Roth IRA is a smart way to diversify your retirement savings and protect your wealth from market volatility and inflation. With the stability of gold and the tax advantages of a Roth IRA, it offers a great path to strengthen your financial future.

If you want to know more about securing your retirement with gold, request our free Gold IRA kit today!

How to invest in Gold Roth IRA: FAQs

Are gold IRAs a good idea?

Gold IRAs or precious metal IRAs can be a good idea if you want to diversify your retirement savings and protect them against inflation and market fluctuations. They combine the stability of gold with the tax benefits of an IRA.

Can you have a Gold Roth IRA?

Yes, you can have a Gold Roth IRA. You get all the benefits of a Roth IRA’s tax-free growth and withdrawals while owning physical gold or other precious metals.

What is the minimum deposit for a Gold IRA?

The minimum deposit for a Gold IRA from Swiss America is $5,000.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.