More and more people are looking for ways to diversify their retirement savings and protect their wealth from uncertainty. If you decide to add gold assets as part of your strategy, what are the Gold IRA withdrawal rules you should know?

This article covers what you need to know about these rules, including when you can access your funds, how taxes work, and what to expect if you take early distributions.

Understanding Gold IRAs

A Gold IRA is a self-directed Individual Retirement Account where you can hold physical gold bullion or other precious metals. It functions just like a traditional IRA that holds stocks or bonds. The main difference is the type of asset you’re investing in.

It’s a way to include precious metals in your retirement portfolio while still getting the same tax benefits that come with other retirement accounts.

You’ll hear people call it a Gold IRA, a Precious Metals IRA, or even a Silver IRA. They’re all referring to the same general idea.

Types of Gold IRAs

When we say “traditional IRA,” it can actually mean two different things, which gets a little confusing.

First, there’s the general idea of a traditional IRA that invests in stocks, bonds, mutual funds, and other mainstream assets. This is the standard retirement account most people are familiar with. Then there are alternative IRAs, which hold assets like gold, real estate, or private equity. These fall under the umbrella of self-directed IRAs.

Inside that self-directed category for holding gold, silver, platinum, or palladium, there are several types of accounts:

Traditional Gold IRA

The traditional version uses pre-tax dollars. Your money grows tax-deferred, and you’ll pay taxes when you start taking withdrawals in retirement, starting at age 59½.

You definitely don’t want to take money out early. If you do, you’ll get hit with a 10% penalty on top of the regular income taxes you’d owe. The whole point of deferring taxes is the assumption that you’ll be in a lower tax bracket by the time you’re ready to start pulling from your Gold IRA. That way, you keep more of what you’ve saved.

Roth Gold IRA

Then there’s the Roth Gold IRA. This one gets funded with after-tax dollars and grows completely tax-free. You can withdraw your original contributions anytime since you’ve already paid taxes on them. The earnings from growth on your original investment can also be withdrawn tax-free if you’ve had the account for at least five years and you’re at the retirement age of 59 1/2.

Another interesting benefit of this account type is that there’s no requirement to ever withdraw your Gold IRA funds. You can leave the assets in the account for as long as you want.

That means you’re free to let the gold sit there indefinitely, and when the time comes, you can pass it on to your heirs. It’s a way to keep your investment growing and potentially transfer wealth without triggering taxes during your lifetime.

SEP Gold IRA

If you’re self-employed or run a small business, you can open a Simplified Employee Pension Individual Retirement Account, or SEP IRA. It works the same way as a traditional or Roth IRA in terms of tax treatment and growth. The main difference is that it’s specifically for people who are self-employed or business owners.

Note that not all custodians allow you to hold precious metals in these accounts.

SIMPLE IRA

For employees of a small business with less than 100 employees, your IRA is actually called a SIMPLE IRA. It stands for Savings Incentive Match Plan for Employees Individual Retirement Account.

Depending on your custodian and plan, you may be able to hold gold in a Roth or traditional IRA version.

Gold IRA Types

| IRA type | Tax treatment | Withdrawals | Eligibility | Other notes |

| Traditional Gold IRA | Funded with pre-tax dollars. Grows tax-deferred. | Taxes due at withdrawal (age 59 1/2+). Early withdrawal = income tax + 10% penalty. | Anyone with earned income (subject to limits). | Strategy assumes lower tax bracket in retirement. |

| Roth Gold IRA | Funded with after- tax dollars. Grows tax-free. | Contributions withdrawable anytime. Earnings tax-free at retirement. | Income limits apply. | No required minimum distributions. Can leave account intact indefinitely and pass to heirs tax-free. |

| SEP Gold IRA | Typically pre-tax. Grows tax-deffered. | Same rules as traditional or Roth IRA, depending on setup. | Self-employed individuals or small business owners. | Contribution limits are higher. Not all custodians allow gold. |

| Simple IRA | Pre-tax or after-tax (depends on plan type). Grows tax-deferred or tax-free. | Rules similar to traditional or Roth IRAs, based on setup. | Employees of small businesses (<100 employees). | May allow gold depending on the plan and custodian. |

Setting up a Gold IRA

Getting started with a Gold IRA is pretty straightforward, and it’s something the Swiss America team helps clients with all the time.

Here are the main steps:

Step 1: Choose a Gold IRA custodian

You’ll work with a custodian who manages your Gold IRA account on your behalf. That includes making sure you’re following IRS rules, handling the reporting, and keeping track of your account status.

If you’re not sure who to use, ask your gold dealer. They can usually recommend custodians they’ve worked with over the years. You can also check online reviews to see what others have said about working with a particular company.

Once you’ve chosen a custodian, you’ll fill out an application and open an account.

Step 2: Fund your account

Now that you have an account set up, the next step is to move funds into it so your custodian can make purchases based on your instructions. You can fund a Gold IRA using available cash, or you can roll over funds from an existing retirement account.

If you’ve left your current employer, you can move over funds from your 401(k) or your SIMPLE IRA. You’ll contact your plan administrator, let them know you want to transfer funds into a self-directed IRA, and complete the required paperwork. They’ll send a check that goes directly to your custodian, who deposits the money into your new account.

If you’re still employed, you can’t usually roll over your current 401(k). But you can move over funds from an IRA that’s not tied to your workplace plan.

Step 3: Buy and store your precious metals

The next step is to purchase precious metals you’ll hold inside your self-directed IRA account. The IRS has specific rules about which types of bars or coins you can buy with retirement funds, and your gold dealer can help make sure you’re choosing metals that meet those requirements.

Once you decide which metals you want, your custodian handles the order and takes care of storing your metals in an IRS-approved depository.

Gold IRA rules and regulations

There’s a few details about Gold IRAs you should be aware of, including:

Account administration

Your Gold IRA custodian handles all the transactions for you, including buying and selling.

You’re not allowed to keep any of the gold coins or bars from your IRA in your personal possession until you reach retirement age. If you try to store the gold at home, the IRS treats it as a distribution, which means taxes and penalties.

Gold IRA contribution limits

You can add to your IRA each year, and the amount the IRS allows depends on your age and the current limits for that year.

In 2026, the maximum contribution is $7,500 if you’re under 50. If you’re 50 or older, you can contribute up to $8,600. This applies whether you’re using a traditional or Roth IRA.

Gold IRA withdrawal rules

Once your gold is in the account, it needs to stay there until you’re ready for retirement, unless you’re willing to deal with penalties. Here’s how the rules work.

Qualified distributions

You need to reach age 59½ before you can take money out of a traditional Gold IRA without a penalty. If you pull funds out before then, the IRS treats it as a non-qualified distribution. You’ll owe regular income taxes plus a 10% early withdrawal penalty.

That said, the IRS does allow a few exceptions. You can avoid the penalty if you use the money for things like qualified education expenses, unreimbursed medical expenses, or buying your first home.

Required minimum distributions (RMDs)

Starting at age 72, you have to begin taking required minimum distributions from your Gold IRA. The amount depends on your account balance and your life expectancy, based on IRS tables.

If you skip an RMD or don’t take enough, the IRS hits you with a 25% penalty on the amount you should have withdrawn. So it’s something you don’t want to overlook.

Early withdrawal penalties

If you withdraw early, you’ll pay a 10% penalty on the amount you take out. On top of that, the IRS treats the withdrawal as taxable income. Depending on your situation, that combination can take a big chunk out of what you receive.

In addition to the penalty, you’ll owe income tax on the full amount of the withdrawal. If the extra income bumps you into a higher tax bracket, you could end up paying even more than expected.

When you add it all up, the tax hit and penalty can be steep. In most cases, it’s worth looking at other options before trying to take Gold IRA distributions early.

Inherited Gold IRAs

Inherited Gold IRAs come with Required Minimum Distributions, and the IRS expects those to start right away.

How much your heirs need to withdraw depends on the original account owner’s age and your relationship to them. The IRS uses that information and the distribution option you choose to calculate the RMDs.

There are also tax implications on those distributions, which the IRS considers ordinary income.

Withdrawing Gold IRA assets

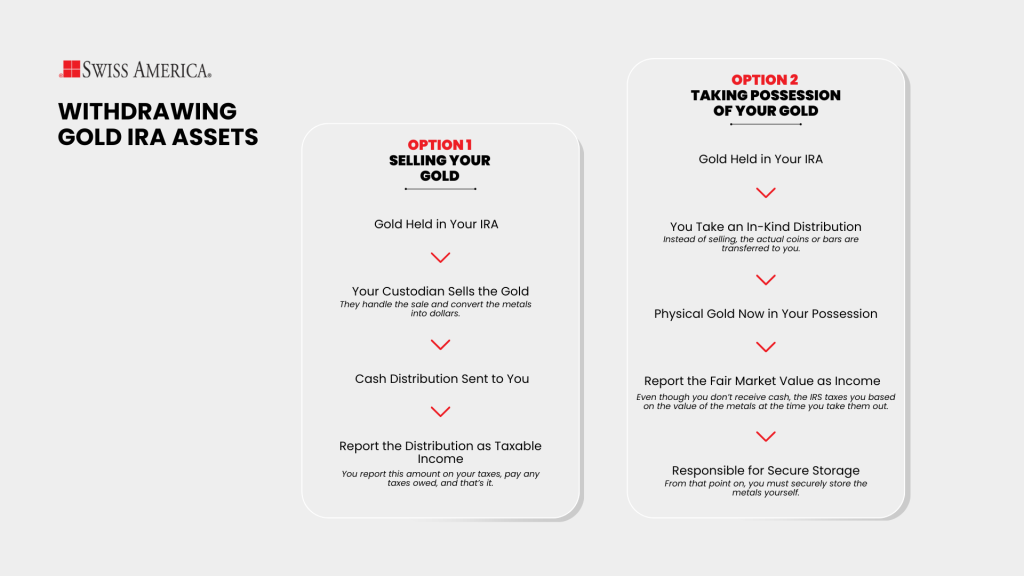

When you’re ready to start taking distributions from your Gold IRA, you have a couple of options:

Option 1: Selling your gold

The first option is to sell the gold inside your IRA and take the distribution as cash. Your custodian handles the sale, converts the metals into dollars, and sends you the funds. This is the more common route since it’s straightforward and easier to manage from a tax standpoint. You report the distribution as income and pay any taxes owed, and that’s it.

Option 2: Taking possession of your gold

The second option is to take what’s called an in-kind distribution. Instead of selling the gold, you transfer the actual coins or bars out of the IRA and into your physical possession. The value of the metals at the time you take them out gets reported as income. So even though you’re not receiving cash, the IRS still taxes the distribution based on the fair market value of the gold.

This option gives you the benefit of holding the physical gold in your hands, but it also means you need to be ready for the tax bill that comes with it. Plus, you’ll be responsible for securely storing the metals yourself from that point on.

Strategic financial planning

When it comes time to start withdrawing from your Gold IRA, a little planning goes a long way. The goal is to make sure you’re getting the most out of your investment without running into avoidable tax issues.

Start by making sure you understand the tax rules and distribution guidelines that apply specifically to Gold IRAs. They’re not the same as pulling from a regular brokerage account, so work with a financial advisor or tax professional to avoid surprises.

Also, consider timing. Whether you take cash or physical gold, the timing of your withdrawal can impact your tax bracket and your overall financial picture. Planning ahead gives you more flexibility and helps you avoid unnecessary penalties or rushed decisions.

Loan alternatives

Taking money out of your Gold IRA before retirement might seem like a solution, but the penalties and taxes can add up fast. Before you go that route, it’s worth looking into other ways to access funds that won’t hurt your long-term savings.

You can’t borrow directly against a Gold IRA the way you might with other types of retirement accounts. That’s why it makes sense to explore other borrowing options first.

A personal loan, a home equity line of credit, or even a short-term loan from a family member could give you the funds you need without triggering early withdrawal penalties or unexpected tax bills.

Before you consider pulling money from your IRA, take a step back and look at these alternatives. They might give you the flexibility you need without compromising your retirement plan.

Benefits of Gold for retirement

Gold gives you a way to invest outside the stock market and add a tangible asset to your retirement plan. It’s known for holding value over time, especially when the economy feels unstable. Note that gold isn’t meant as a growth asset but rather to protect what you’ve already built.

One of the main reasons people add gold is to create balance. Most retirement accounts have a heavy tie to stocks, bonds, or the dollar. If those take a hit, your savings can take a hit too. Gold doesn’t move in lockstep with the market, which means it can hold steady or even climb when everything else is under pressure. That difference can help smooth out the bumps over time.

It also holds up against inflation. As the cost of living rises, the value of cash tends to fall. Gold has a track record of keeping pace, which makes it useful when you’re thinking about long-term purchasing power.

And then there’s the fact that gold is real. It’s not a digital balance or a promise from a company. It’s a physical asset you can actually own. For a lot of people, especially heading into retirement, that kind of security brings peace of mind.

Gold isn’t meant to replace your entire portfolio. But if you’re looking to protect your savings, hedge against risk, and add something with staying power, it’s a good idea to add it to the mix.

What to look for in a Gold IRA provider

Choosing the right gold dealer matters, especially when you’re trusting them with part of your retirement plan. Here are a few things to look for:

Longevity

Look for a dealer that’s been around for the long haul. Companies that have lasted decades are usually doing something right and aren’t just trying to make a quick sale. Swiss America has been in business for over 40 years, which says a lot about our reputation and ability to guide clients through all kinds of market conditions.

Customer reviews

Read what other people are saying. Customer feedback gives you a sense of how a company treats its clients. Swiss America consistently earns strong reviews for both customer service and overall experience.

Educational resources

A good dealer helps you understand what you’re buying. Whether you’re looking at gold, silver, or platinum, you should have access to helpful information. Swiss America offers a free Gold IRA kit, weekday market updates, and ongoing podcast episodes to help you learn and stay in the know.

Credentials

Always check credentials. A reputable gold dealer is part of respected industry organizations. Swiss America is a member of the American Numismatic Association, the Industry Council for Tangible Assets, and Numismatic Guaranty Corp. These affiliations show we’re committed to doing things the right way.

Final thoughts on Gold IRA withdrawal

Knowing how Gold IRA withdrawals work helps you avoid penalties, plan around taxes, and keep more of what you’ve saved.

To learn more about how Gold IRAs can enhance your retirement savings, connect with the Swiss America team today!

Gold IRA withdrawal rules: FAQs

Do you pay tax when you sell Gold IRA money?

Yes, if it’s a traditional Gold IRA, you’ll pay income tax on whatever you take out. With a Roth, you can avoid taxes as long as you follow the rules.

Can you withdraw from a Gold IRA?

You can, but if you’re under 59½, you’ll likely face taxes and a 10% penalty unless you qualify for an exception.

What is the downside of a Gold IRA?

You can’t hold the gold yourself, there are storage fees, and if you withdraw early, the penalties can be steep.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.