There’s a lot of interest in how to use retirement accounts to invest in physical gold or other precious metals. How do you get started? And what’s involved? Those are the questions our free Gold IRA kit can answer.

This article covers what’s in Swiss America’s kit and how to get started with a Gold IRA account.

What is a free Gold IRA kit?

The free Gold IRA kit is a book on how to use your retirement savings to buy gold investments. It explains the reasons why more investors are adding gold and other precious metals to their savings plans. Plus, it also has all the details on following IRS rules to set up your account so that you get the most tax benefits possible.

How to get your free Gold IRA kit

You can get a free Gold IRA kit from Swiss America by filling out the form here or clicking to call on the box at the bottom of this page. The process is simple and takes just a few minutes.

Our experts will gather your shipping information and mail the kit to you promptly. There’s no obligation or cost to request your kit, so it’s an easy way to see if a God IRA is right for you.

The kits ship via regular mail and arrive within 3-10 business days.

Contents of a free Gold IRA kit

Here’s what Swiss America’s free Gold IRA kit includes:

Information kit

First, get all the information you need on what’s involved. Many of the same rules you see with traditional IRAs apply here. Options include traditional Gold IRAs or Roth Gold IRAs, which have different tax benefits and rules.

If you’re looking to transfer funds from an employer plan like a 401(k), 403(b), or TSP, we cover how you can roll over a portion or all of those accounts into a Gold IRA without penalties.

You’ll also get details on who manages your account. In traditional IRAs, brokerage companies manage your funds. In Gold IRAs, precious metals IRA custodians manage these accounts on your behalf.

Physical gold details

Since a Gold IRA means you actually own physical gold, the kit covers which gold coins or bars you can buy. The IRS sets these rules to protect investors from fraud and to verify the legitimacy and quality of their investments.

The approved metals rules include details on the levels of purity and eligible manufacturers. Some commonly approved gold coins include the American Gold Eagle, Canadian Gold Maple Leaf, South African Krugerrand, and Australian Gold Kangaroo.

Silver and platinum options

Even though we refer to this as a free Gold IRA kit, you can actually buy other precious metals like silver and platinum. You may hear the terms “precious metals IRA” or “silver IRA.” Both refer to the same concept of holding physical metals inside your retirement accounts.

There can be good reasons to include these metals since they both have different demands and add diversification to your overall savings.

Just like with gold, there are IRS rules about which coins and bars qualify.

For a quick overview, here’s a glance at the components and how they help you:

| Kit component | What it covers | Why it matters | Who it helps most |

|---|---|---|---|

| Gold IRA basics | Explains how Gold IRAs work and IRS rules | Helps newcomers understand the foundation | First-time investors |

| Rollover & transfer info | Steps/requirements to move retirement funds | Guides you through avoiding penalties | Investors with 401(k), TSP, IRA |

| Approved metals guide | Lists eligible gold, silver, platinum options | Clarifies what qualifies for IRS compliance | Anyone buying metals |

| Precious metals comparisons | Silver and platinum options vs gold basics | Helps diversify metal choices | Investors exploring variety |

How a free Gold IRA kit helps with retirement planning

Why do free Gold IRA kits exist? Many investors want to learn more about using their retirement accounts to buy physical gold but may not know what’s involved. The kits help answer these questions with information on things like:

Customer service and support

The best Gold IRA companies provide educational materials and strong customer support to help you make the right investment decisions. You may be interested in gold investing but want to know about what other metals you can add.

Common questions we help investors with include:

Which metals should I buy?

Should I buy bars or coins?

What are the pros and cons of each precious metals option?

Gold IRA custodians and self-directed IRAs

Just like traditional IRAs have a brokerage or investment firm that manages your overall retirement account, a Gold IRA custodian handles an account that holds gold. The role of a custodian is to manage your money according to your directions, provide annual reporting, securely store your metals, and comply with IRS rules.

You’ll work with the custodian to open a self-directed IRA account. This allows you to make investments beyond the normal stock market options. Self-directed basically means that you tell the custodian what to buy and sell on your behalf.

Storage options and fees

With precious metals IRAs, you don’t take possession of your metals until you reach retirement age. Instead, your precious metals IRA custodian places them in a secure storage depository. These are third-party facilities built to safely store metals.

You can decide what type of storage you want, including:

Comingled storage

This means that your metals get stored with other investors’ metals. This costs less, and sometimes, you’ll see custodians offering promotional free storage options. Flat fees are between $50-$150 per year. Some companies charge variable fees based on the value of your individual retirement account.

Segregated storage

With this type, your metals are completely separate from other investors’ metals. Costs here can be between $100-$300 per year or variable fees on account value.

Benefits of gold investments

Gold IRAs exist to help investors own tangible precious metals assets with their retirement money. You can do this with all account types like traditional Gold IRAs, Roth Gold IRAs and SEP Gold IRAs.

The whole point of a Gold IRA kit is to give you the information you need to decide whether holding gold in your retirement account is right for you. The kit also gives details on the benefits of adding gold to your retirement savings like:

Safe haven asset

Gold does not rely on any country’s currency or the stock market. It’s a completely independent investment that actually does very well during times of crisis or economic uncertainty. That’s why many investors consider it a safe-haven asset and buy it when they want safety.

It’s almost like an insurance policy because it can protect your wealth whenever things go wrong with the economy. Like all investments, no one can guarantee how gold reacts but historically it does well in times of crisis.

Portfolio diversification

Because gold and silver investments react so differently to what’s happening in the world, they are a great way to diversify your portfolio. Instead of having all your money tied to the stock market or bonds, physical metals give you other assets to balance out market ups and downs.

That’s why many financial advisors recommend holding 5%-15% of your portfolio in precious metals as a way to protect your savings from risk.

Inflation hedge

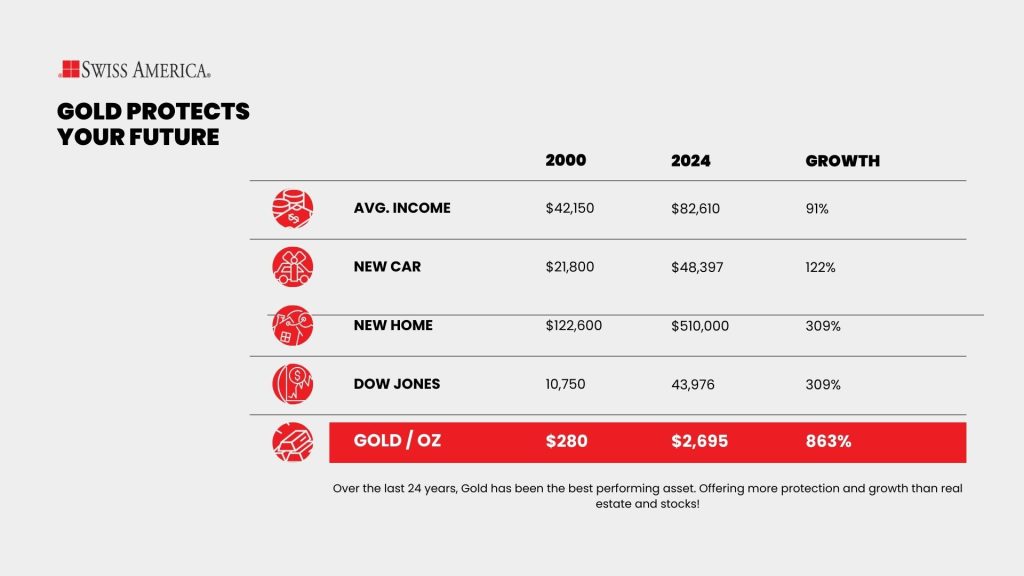

You’ll often hear investors refer to gold as an inflation hedge. The reason for this is that when you buy gold, you’re buying a tangible asset. As that asset gains value, it can help protect your money from losing its purchasing power.

Gold, silver, and platinum are limited in supply. Unlike paper currency, which governments can print endlessly, these assets can’t just be created out of thin air. Each time the government prints more money, it drives up the cost of goods and services and chips away at the value of your portfolio if it doesn’t keep pace with inflation.

Just like any investment no one can guarantee this every time but it’s one way to potentially shield your savings from inflation.

Final thoughts on free Gold IRA kits

Getting a free Gold IRA kit is a no-obligation way to understand what’s involved. You can use this information to see if this type of account is right for your situation. Since the point of the kit is to give you all the details you need, it’s a great way to see if a Gold IRA is the right path for you.

To request your free Gold IRA kit from Swiss Amercia, click here to submit your request and get your kit today.

Free Gold IRA kit: FAQs

Is the Gold IRA kit real?

Yes, the Gold IRA kit is real. It’s a book that Swiss America mails to you which gives you all the details on how to get started with a Gold IRA.

Are Gold IRAs a good deal?

Yes. A free Gold IRA kit doesn’t cost you anything so it is a good deal. It gives you the information you need to see if a Gold IRA is right for your retirement money.

Are Gold IRA kits legit?

Yes, Gold IRA kits are legit. Gold IRA companies like Swiss America create these informational guides to help you decide if a Gold IRA is right for you. They include the details on how Gold IRAs work and how to get started investing.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.