Will there ever be a currency reset? No one knows for sure, but what we do know is that debt is out of control, the economy is shaking, and parts of the world are in geopolitical chaos.

As of August 2024, the United States is now 35.26 trillion dollars in debt, which matches our entire Gross Domestic Product (GDP). This staggering amount has several investors and leaders concerned about our economy and ability to grow.

Investors seek safety, which often leads them to gold or other precious metal assets. This article covers historical currency resets, current concerns about the U.S. dollar, and ways to secure your wealth for whatever the future may hold.

What is global currency reset?

This concept is that world currencies reset and change to new currency systems at some point in the future. People speculate this might happen to address discrepancies in global trade and that reset could point to a currency that follows:

Gold standard

GDP

Other economic indicators

There are historical instances of currency resets that can help to understand the impact of a reset:

The Bretton Woods Agreement (1944)

This agreement, created during World War II, established the International Monetary Fund. It also created a system of fixed exchange rates between currencies. The agreement made the US dollar the world’s reserve currency tied to gold at $35 per ounce.

The Nixon Shock (1971)

In 1971, the US faced rising unemployment and inflation along with a growing trade deficit. The dollar also experienced value pressure due to a global dollar surplus. In response to these economic challenges, President Nixon ended the dollar’s convertibility to gold and introduced a 90-day freeze on wages and prices to combat inflation. These events became known as the “Nixon Shock.”

The Plaza Accord (1985)

On September 22, 1985, the United States, Japan, West Germany, France, and the United Kingdom sought to depreciate the U.S. dollar against the Japanese yen and German Deutsche Mark. The agreement required coordinated intervention in currency markets because the dollar’s high deprecation hurt U.S. exports.

Modern-day global financial system

Today’s global currency system includes a network of organizations and markets, including:

Central banks: Most countries have central banks that manage national fiat currency.

Commercial banks: These banks handle currency exchanges and international transactions.

Financial markets: The global foreign exchange (FOREX) market trades global currencies.

Regulatory bodies: Manage and regulate currency markets and financial institutions.

International financial institutions: Organizations like the IMF that provide analysis, loans, and policy recommendations to member countries.

Here’s a recap of major historical currency reset events and what they meant for global money systems:

| Event | Year | What changed | Connection to modern concerns |

|---|---|---|---|

| Bretton Woods Agreement | 1944 | Established gold-linked fixed exchange rates and the IMF | Shows how gold once anchored global currency systems, a reference point in reset discussions |

| Nixon Shock | 1971 | US ends dollar convertibility to gold | Marked the shift to fiat money and rising currency instability concerns |

| Plaza Accord | 1985 | Coordinated intervention to depreciate the US dollar | Example of global cooperation to influence currency value, relevant to de-dollarization talks |

Current concerns leading to currency reset speculation

What’s driving today’s conversations around currency reset? Many investors are concerned about America’s rising debt, the impact of the BRICs alliance, and economic instability.

U.S. Debt

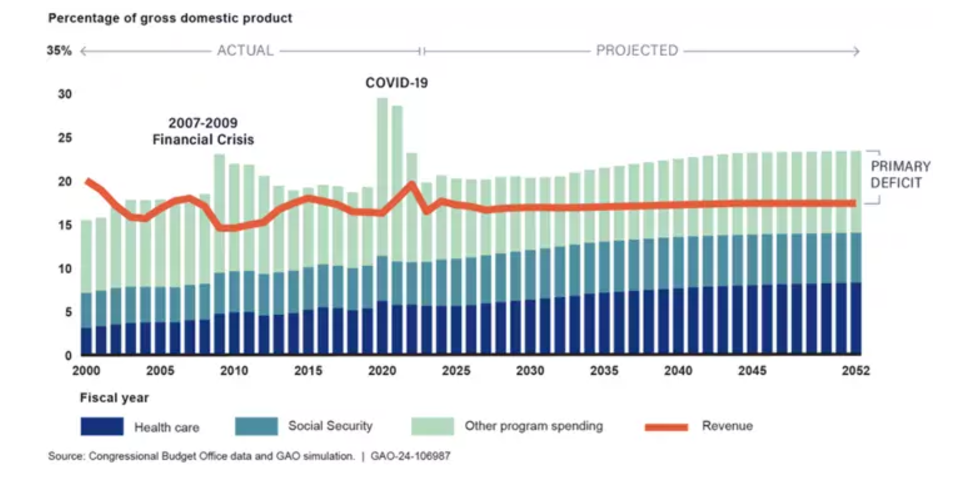

Since 2002, the US government has spent more than it makes in tax revenue. Every year this amount grows and demographic factors like an aging population and healthcare expenses increase the problem. The debt also increases as a result of interest rates on payments owed to investors. And, the Government Accountability Office (GAO) estimates that starting in 2029, we’ll pay more $1 trillion in interest costs each year.

The harder it is for the US government to service its debt, the more investors get concerned about potential default. You can see the overall impacts in the chart below from GAO shows the rising budget deficit compared to revenues as well as costs for Social Security and Healthcare.

Currency devaluation

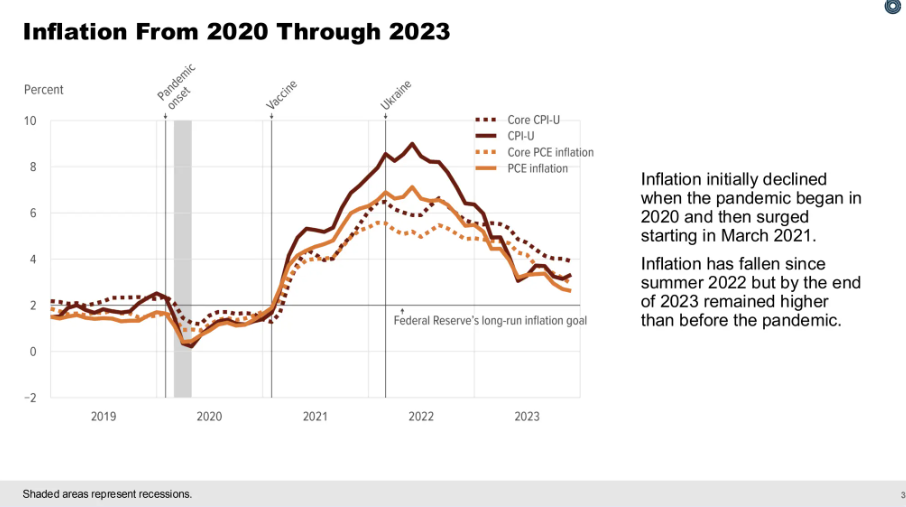

We’ve discussed the potential decline in currency values of the US dollar on several of our podcast episodes. If investors lose confidence in the US Dollar as a store of value, it could cause impacts like rapid selling off of US Treasury bonds and dollar-denominated assets by investors. Or, if we experience high inflation like we recently saw in 2022, which makes imports more expensive and reduces purchasing power.

The chart below from the Congressional Budget Office provides a visual on inflation from 2020 to 2023.

Economic instability

Trade wars like the one the U.S. is having with China can create discussions around currency instability. The U.S. began imposing higher tariffs on goods from China in 2018, which caused China to retaliate. The impact of this trade war affects over $106 billion of U.S. goods.

Current geopolitics tensions between Israel and the Middle East have impacted oil production, decline in regional tourism, and supply chain disruption from Houthi attacks in the Red Sea.

All of this creates concern that leads to currency changes, market volatility, and reduced foreign investment.

Central bank policies

Investors watch central banks and their policies around quantitative easing (QE) which can destablize several or a single global currency. QE is when governments create new money which causes an increased supply and can lead to currency devaluation compare to other currencies.

We recently discussed de-dollarization on our podcast:

Global currency reset and gold

For years, investors look to gold as a stable asset to protect their wealth during economic uncertainty. In today’s environment, we see increased interest in gold due to:

Gold as a store of wealth

Gold can be an investment that provides a return but usually people buy gold as protective asset. The whole goal is to stop your wealth from eroding due to either inflation, stock market ups and downs or other factors.

Right now gold is over $2600/oz which is a 26% increase from the start of 2024. Investors and central banks buy gold every time we hear bad news about the global economy, U.S. economic growth or potential government policies.

Recent surveys from the World Gold Council show how central banks increasingly view gold as a critical asset for economic stability, with 81% of respondents planning to buy more gold in the next 12 months:

Gold’s role in a potential currency reset

The future of global currencies remains uncertain, but some potential ways gold might be a part of any changes include:

Speculative outcomes for gold

One potential speculative outcome of a global currency reset is the reintroduction of gold-backed currency. This could happen if governments seek to restore the confidence of their money in the global financial markets by tying its value directly to gold. This return to a gold standard could provide a foundation for global reserve currency.

Owning physical gold as a hedge

People considering investing in gold should be aware of the different options for holding gold. The optimal path is to hold physical gold instead of investing in paper assets like mining stocks or gold mutual funds.

When you own and store physical gold, you get the benefits of an investment hedge plus:

No counterparty risk

Your gold doesn’t need a 3rd party entity to perform in order for you to hold gold. Banks might go out of business, digital systems may fail and companies may have a terrible earnings quarter. None of those things matter for your gold investments.

No cyber risk

Your investment can’t get hacked. You don’t need an internet connection, a secure password or a mobile app to control your gold.

Diversification

Many people recommend holding a portion of your portfolio in gold as a way to diversify and reduce risks. You can see this in community forums as well, like user jrichar on the Reddit r/Preppers forum, who shared:

Diversification is the key to managing risk in your investments. It’s a good idea to have some gold, silver, land, bitcoin, 401k, stocks, and other retirement funds in your portfolio.

Some people in this subreddit like to imagine extreme scenarios, where traditional forms of currency become worthless and they have to trade goods for survival. While it’s important to be prepared for emergencies, it’s also important to consider more realistic situations. For example, Argentina is currently experiencing inflation, Cyprus had a banking crisis in 2012, and the US dollar has lost a lot of purchasing power since it stopped being backed by gold.

By diversifying your investments and avoiding debt, you can better weather unexpected events or financial crises.

How to invest in gold

You can invest in physical gold with four easy steps:

Step 1: Research dealers: Find a reputable precious metals dealer by looking at how long they’ve been in business, customer reviews, and the kind of resources they provide to advise your investment strategy.

Step 2: Open an account: Set up your account to buy gold, silver, or other metals. If you are buying inside of your retirement account, like a 401(k) rollover or Gold IRA, you’ll need to choose an IRA custodian first and then direct them as to which precious metals to buy.

Step 3: Arrange storage: Receive your metals and arrange for secure storage and insurance. For your Gold IRA, the custodian handles these logistics through an IRS-approved depository.

Step 4: Monitor your account: Swiss America customers can easily see the status of their gold financial transactions and portfolio value through our customer portal. When you want to liquidate or sell, you can also get valuations through this same platform.

Why investors choose Swiss America

The Swiss America team has helped thousands of investors buy gold, silver and platinum for over 40 years. Reasons why customers rely on our team include:

Customer service: Customers rave about their experience working with our team, receiving their metals, and getting ongoing help as needed.

Educational resources: We provide regular educational resources and guidance to help you with gold investing. This includes assistance with retirement rollovers to a Gold IRA, recommendations for third-party storage, and in-depth research reports on the gold market.

Buy-back program: Our customers benefit from our buy-back program, which makes it easy to sell gold or other precious metals if needed.

Credentials: Our membership in the American Numismatic Association, Industry Council for Tangible Assets, and Numismatic Guaranty Corp demonstrates our commitment to quality metals and support.

Global currency reset final thoughts

No one knows for sure if the global markets will lead to a future currency reset. But what we do know is that the U.S. debt keeps rising, our financial markets are skittish, and there’s constant geopolitical chaos.

One of the best ways to prepare for what may come is to look at historically safe haven investments like gold.

If you want to learn more about how to invest, contact our team today!

Currency reset: FAQs

Is there a new world currency coming?

As of right now, there isn’t a new world currency planned. Some countries may discuss alternatives to the U.S. dollar for international trade, but these discussions have not led to any official new global currency.

Is dollar being replaced as world currency?

Some nations are exploring alternatives to the U.S. dollar for trade purposes but as of right now, there aren’t changes to the world currency.

What will be the global bridge currency?

There is no official global bridge currency, but some people speculate that digital currencies or stablecoins could fill this purpose in the future.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.