74% of Americans worry about the price of food and goods. Inflation increased prices by about 22% since 2020, so the same amount of money doesn’t go as far as it used to. That’s why more people are looking to invest in Gold IRA to protect their retirement savings.

This article covers how Gold IRAs work, why owning physical gold can help your portfolio, and steps to get started investing in precious metals today.

Understanding Gold IRAs

Gold IRAs are a specific kind of individual retirement account where you can hold physical gold bullion and other precious metals. Traditional IRAs only let you invest in paper assets like stocks and bonds, but a Gold IRA gives you a way to use your savings and buy tangible metal assets.

Gold IRAs go by a few different names that all mean the same thing:

Physical Gold IRA

Self-directed Gold IRA

You can open this type of retirement account with specialized custodians since traditional brokers do not offer these accounts.

Benefits of investing in a Gold IRA

If you’re wondering why someone would decide to set up a Gold IRA account, here’s the key reasons we see:

Diversification

If you only have paper assets in your retirement savings, you have some risks:

Stock market moves: The stock market can be a rollercoaster of highs and lows at different times.

Third-party performance: Paper assets like gold stocks need the company to do well in order for your investment to have value.

Policy risk: Depending on the investments, you might have risks from changes in government policy, like increases in tariffs that impact the sales of certain products.

Gold is a completely independent asset. Here’s why:

Not related to currency: The value of gold isn’t tied to any one country’s currency and it has global worth.

Performance: Gold doesn’t react the same as the stock market to bad news… in fact, that’s when it usually does very well.

No counterparty risk: You don’t need someone else to perform for your gold to have value.

So if you purchase gold with a portion of your retirement savings, it gives you a way to reduce your risk and protect your wealth.

Inflation hedge

Gold can be a great way to protect your money from the eroding effects of inflation. It’s a scarce resource and the government can’t just make more like they do with paper currency. This limited availability helps it hold value so that when costs for all goods and services rise, the cost of gold rises, too.

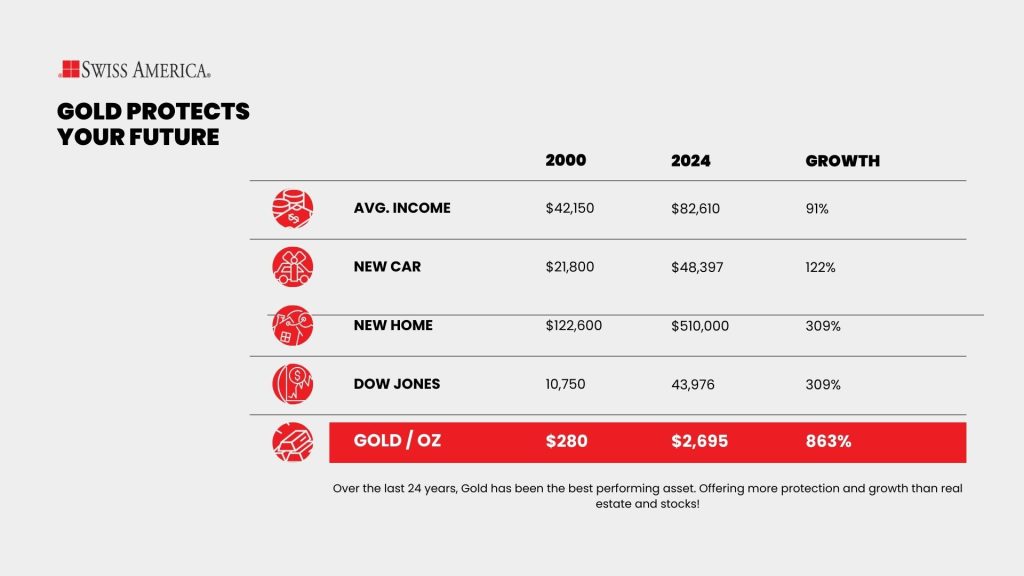

Take a look at our chart showing gold versus inflation for the last 24 years:

Tax advantages

A gold or precious metal IRA gives you the same tax benefits as a traditional IRA. These include:

Traditional Gold IRA

With traditional Gold IRAs, you contribute pre-tax money. Your investments in gold and silver or other metals grow tax-deferred. Then, when you reach the retirement age of 59.5, you can withdraw from your account and pay taxes. The benefit is that you might be in a lower tax bracket at that time.

A caveat is that you’ll have IRS-required minimum distributions starting at age 73, so you can’t keep your investments in the account forever.

Roth Gold IRA

You fund a Roth IRA with after-tax dollars, and then your investments grow tax-free. You can take out your contributions at any time since you already paid taxes on them. Meanwhile, your proceeds grow, and you can withdraw in retirement tax-free as long as you’ve held the account for at least five years.

The benefit of this account type is that you don’t have the required minimum distributions and can pass on your metals to your heirs tax-free.

SEP Gold IRA

If you’re self-employed or own a small business, you can use this type of account to hold precious metals. It works just like a traditional IRA using pre-tax dollars.

Types of Gold IRAs

| Feature | Traditional Gold IRA | Roth Gold IRA | SEP Gold IRA |

| Tax treatment | Pre tax contributions taxed withdrawals | After tax contributions; tax-free growth | Pre tax contributions; taxed withdrawals |

| Required minimum distribution | RMDs at age 73 | No RMDs | RMDs at age 73 |

| Best for | Lower tax bracket in retirement | Higher tax bracket in retirement | Self-employed or small business owners |

Risks and considerations

Holding physical gold bullion coins or bars in your retirement account is a great safety net, but just like with any investment, you should also be aware of the potential drawbacks.

Market volatility

The price of gold, silver, and other metals can vary. Like all investments, there’s no guarantee of performance and value. That’s why it’s a good idea to look at gold as a long-term investment and a way to protect your wealth over time.

Storage and custodian fees

All investments come with fees. For gold individual retirement accounts, these include custodian management fees. They also include the costs to store precious metals since the IRS won’t let you take actual physical possession until you reach retirement age.

Compare Gold IRA custodian fees and ask your precious metals dealer for recommendations to find the best option.

No income

Gold doesn’t generate cash flow or pay dividends. Most investors are OK with this because the whole point of owning gold is as an “insurance policy.” Consider it an asset to protect your wealth over the long term.

Setting up a Gold IRA

Getting started with gold or precious metal IRAs is easy. The key steps include:

Choosing a custodian

Start by choosing a Gold IRA custodian. They perform a similar function to your traditional retirement account administrator. This includes managing your funds, providing statements, and reporting to the IRS.

They also buy and sell gold on your behalf and they take of storing your metals with a third-party depository.

Look for companies that have IRS approval, have been in business for several years, and have great customer reviews.

Funding your account

Next, you need to add retirement funds to your account. There’s a few options here:

Rollover employer plans: If you have an individual retirement account at a previous employer like a 401(k), 403(b), or TSP, you can rollover all or a portion of these funds into a Gold IRA.

Convert existing IRA: What if you already have a traditional retirement account? You can also convert all or a portion of this account into a gold or precious metals IRA.

Start a new account: You can also start a new Roth IRA account where you contribute after-tax money.

Purchasing gold

Once your money is in the account, it’s time to pick out which metals you want to buy. The IRS has specific rules about which physical precious metals qualify:

Types of metals: You can buy gold, silver, platinum, and pallidum for these retirement accounts.

Purity: The IRS has purity rules for each of these metals. Gold must be 99.5% pure, silver must be 99.9%, and both platinum and palladium must be 99.95%.

Manufacturer: Which ever bullion you buy, it must come from government mints or approved manufacturers.

Form: You can buy bullion coins or bars. Note that collectible or numismatic coins do not qualify.

Example approved coins include:

American Gold Buffalo

Austrian Philharmonic

British Gold Britannia

Canadian Gold Maple Leaf

Example approved bars include:

PAMP Suisse Gold Bars

Valcambi Gold Bars

Royal Canadian Mint Gold Bars

Credit Suisse Gold Bars

Perth Mint Gold Bars

Storage

As we mentioned, once your IRA custodian buys your metals, they’ll take care of secure storage with an IRS-approved depository. There’s a couple of options for storage:

Segregated storage: With this option, the depository stores your metals separately from other investors. This approach has higher storage fees.

Commingled storage: Depositories also can store your metals with other investor’s metals in a shared space.

Precious Metal Storage Options

| Feature | Segregated storage | Commingled storage |

| Definition | Your gold is stored separately | Your gold is stored with others’ assets |

| Security | Highest level of individual security | High overall security |

| Cost | Higher cost ($150+/year) | Mosre cost-effective ($100+/year) |

| Asset identification | Your metals easily identifiable | Part of a larger pool |

Gold IRA costs and fees

We briefly covered that just like traditional retirement accounts, your Gold IRA has fees and costs to keep in mind. These can be very different depending on which company you work with. Here’s the types of fees you can expect:

Setup fees: There’s a setup fee to establish your specialized individual retirement account. The cost is around $50 to $300 so it pays to compare options.

Maintenance fees: Custodian account fees for annual maintenance can be between $75 to $300. Some providers might charge a varible fee that depends on the value of your account. These costs cover administrative tasks and IRS reporting.

Storage fees: You’ll also have storage fees which depend on the type of storage you pick.

Transaction fees: Some custodians may charge transaction fees for selling or exchanging your metals. Again, it’s worth comparing providers. For instance, Gold Star Trust, which is a provider we often recommend, does not charge transaction fees.

Alternatives to Gold IRAs

If you want to hold gold but you don’t want to own the physical asset, there are some options with traditional investments.

Gold ETFs and mutual funds

Gold ETFs are exchange-traded funds that allow you to invest in a fund that holds gold. You can buy and sell your shares in these funds just like stocks.

The drawback of these investments is that there could be tracking errors, and you’ll have potentially high management fees.

Gold stocks

You could buy stocks in individual mining companies as a way to potentially benefit from increases in the value of gold.

The disadvantage of this approach is that you’ll need to rely on the company’s performance, which may or may not reflect the actual performance of gold prices.

Precious metals dealers

When it’s time to choose a precious metals dealer, how do you decide? Here’s our take on areas to consider:

Reputation: Look for a company like Swiss America that’s been in business for decades and has thousands of happy customers.

Education: The best Gold IRA companies provide education and resources to help you make decisions about your retirement savings. Check out our free Gold IRA kit, regular podcast episodes, or daily market updates to learn more about physical gold investing.

Credentials: Make sure the company participates in industry trade and professional groups like the American Numismatic Association, Industry Council for Tangible Assets, or Numismatic Guaranty Corp.

Gold IRA investing final thoughts

If you worry about potential risks to your portfolio and want a way to reduce some of your exposure to these risks, a Gold IRA can be a great option. Consider allocating a portion of your overall retirement portfolio to gold or other physical metals to diversify and balance your savings.

Ready to learn more about adding physical gold and other precious metals to your IRA? Connect with the Swiss America team today!

Invest in Gold IRA: FAQs

Do you pay tax on Gold IRA?

Tax for Gold IRAs work just like traditional IRAs. If you have a Gold Roth IRA, you pay taxes before you invest, so your contributions and qualified withdrawals are tax-free. If you have a traditional Gold IRA, you’ll invest with pre-tax dollars and then pay taxes when you make withdrawals in retirement.

What is the downside of a Gold IRA?

The reason people buy gold is to protect their wealth so the main downside is that gold doesn’t generate income. It’s more of an “insurance policy” or store of wealth.

Can you withdraw from a Gold IRA?

Yes, you can withdraw from a Gold IRA once you reach age 59.5 without penalty. You can ask your custodian to sell the metals and send you the proceeds, or you can ask them to ship them to you.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.