If you have retirement funds from a previous employer and you’re wondering if there’s more you can do with those savings to protect your future, a 403(b) Gold IRA might be worth considering.

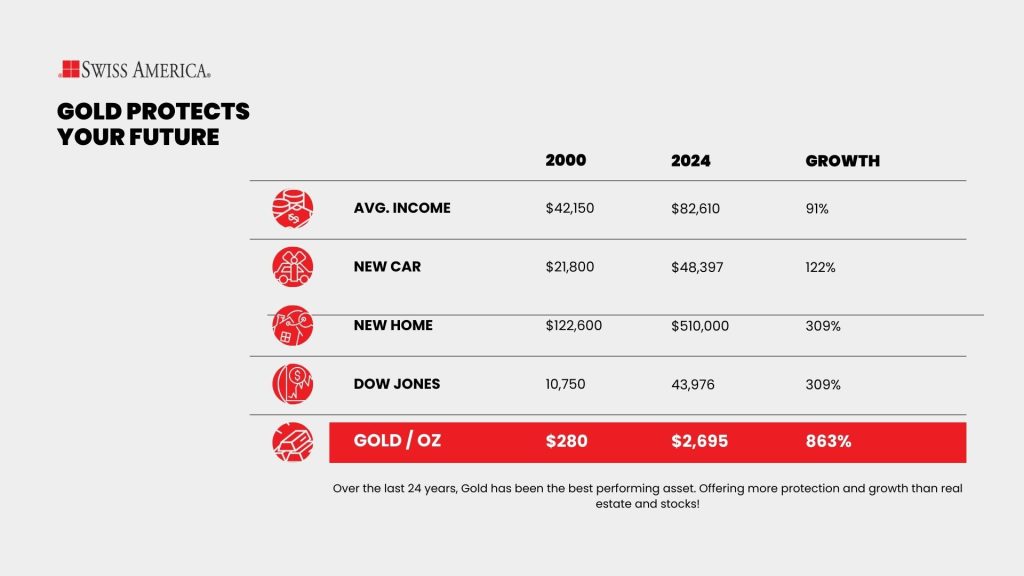

According to Pew Research, 28% of people in the United States believe their financial situation will be worse a year from now. There are a number of reasons for that, but if you’re worried about your financial future and want protection from things like stock market volatility, gold might be the answer.

This article covers how the rollover process and IRS regulations to make the transition without penalties or tax implications.

Understanding 403(b) plans

If you work for a public school, a nonprofit, or certain religious organizations, a 403(b) plan is one way to set aside money for retirement. This retirement savings vehicle is similar to a 401(k) or the Thrift Savings Plan (TSP) if you’re familiar with those.

The way it works is that you contribute pre-tax income directly from your paycheck into the plan. That money grows tax-deferred, so you don’t pay taxes on it until you start withdrawing it in retirement.

Depending on your employer, you might also have access to a Roth 403(b). The big difference here is how the taxes work. With a Roth, you’re putting in money that’s already been taxed. But once it’s in the account, your investments grow tax-free, and as long as you wait until age 59½ to withdraw, you won’t pay taxes on that money.

This plan gives you access to invest in traditional assets like stocks and bonds. But once you leave your job, you’re no longer limited to that basic menu. You can roll your 403(b) into an IRA and invest in a much broader range of assets, such as precious metals like gold and silver, real estate, or crypto.

What is a Gold IRA?

A Gold IRA is a type of retirement savings account you can set up using funds from your employer-sponsored plan. It’s a self-directed IRA (SDIRA), which means you’re in control of the investments and have more options. This includes adding physical precious metals like gold, silver, platinum, and palladium. People refer to it as a precious metals IRA or a silver IRA.

It’s a way to add tangible assets to your portfolio and take advantage of the stability of physical gold or other metals. For many investors, that means an extra layer of protection against inflation, market swings, and economic uncertainty.

Benefits of a Gold IRA rollover

The biggest benefit of rolling over a 403(b) into a Gold IRA is the chance to bring diversification and stability into your retirement portfolio. If you’ve ever watched your investments swing with every market headline, you know how unpredictable things can feel. Stocks rise and fall on sentiment, news cycles, or economic shifts that are completely out of your control.

Gold and other precious metals behave differently from traditional assets. They tend to hold their value when markets get rocky, which can help balance out the ups and downs in the rest of your retirement portfolio.

Besides diversification, here are some other benefits of a precious metals IRA account:

Inflation hedge

Gold is especially strong at protecting your wealth from inflation. There’s only so much of it in the world, and that limited supply helps drive its lasting value. The government can’t just create more gold like it does with paper money.

Gold tends to rise when inflation picks up and the dollar loses purchasing power. Gold investments allow you to use today’s dollars to buy an asset that keeps up with inflation. So when it’s time to sell and access your funds, you have a greater chance of holding your ground and protecting your savings from losing value.

Safe-haven asset

Gold is one of those assets people turn to when things get shaky. And it’s not just individual investors. Over the past three years, central banks have purchased more than 120% more gold each year compared to the previous decade.

Why? Because they’re worried about economic downturns, the strength of the U.S. dollar, and the ripple effects of unpredictable policies and geopolitical conflicts. When uncertainty rises, they move money into gold as a way to protect their reserves.

Gold works as a safety net because it operates outside the paper currency system. It isn’t tied to central banks or government-issued money. That separation is what gives it power as a safe haven when everything else feels unstable.

Tax benefits

Gold IRAs come with the same tax advantages as traditional IRAs. The IRS treats them the same way, so the familiar rules still apply.

Here’s a closer look at the two types of retirement savings and the tax implications:

Traditional Gold IRA

If you’ve added pre-tax money to your retirement savings, you can roll those funds into a new gold IRA while keeping their tax-deferred status. The account keeps growing without triggering taxes until you retire.

When you start taking withdrawals, the money counts as ordinary income. You’ll pay taxes based on your tax bracket at that time. Many people choose this route because they expect to land in a lower bracket once they stop working.

There are some IRS regulations to keep in mind, including required minimum distributions once you reach age 73. At that point, the IRS requires you to start withdrawing a certain amount from your account each year, whether you need the funds or not.

Roth Gold IRA

If your 403(b) account is a Roth, you can roll over into a Roth Gold IRA. The account grows tax-free, and as long as you’re at least 59½ and have held the account for five years, your withdrawals are completely tax-free too.

You can also take out your original contributions at any time since you’ve already paid taxes on that money. Another benefit is that the IRS doesn’t impose required minimum distributions on Roth Gold IRAs. You can keep your precious metals in the account for as long as you want and even pass them on to your heirs.

Rules for a 403(b) to Gold IRA rollover

To be eligible for a Gold 403(b) rollover, you must no longer be employed by the organization that sponsored your plan. In some cases, exceptions may apply for things like disability or severe financial hardship, but you’ll need to check with your plan administrator for the exact rules.

There are two methods for the rollover process:

Rules for a 403(b) to Gold IRA rollover

| Component | Direct rollover | Indirect rollover |

| How funds are moved | Funds transfer directly from your 403(b) plan to your Gold IRA custodian | Your plan sends funds to you; you must deposit them into your Gold IRA |

| Tax risk | Tax-deferred or tax-free it you have a Roth IRA | If you miss the 60-day deadline, funds become taxable and may incur penalties |

| IRS withholding | No mandatory tax withholding | 20% of the distribution is withheld for federal taxes; you must cover the shortfall |

| Process simplicity | Simpler and safer process | More complex with a higher chance of mistakes |

| Deadline | No transfer deadline | You must complete the rollover within 60 days |

| Best for | Most investors | Only when direct rollover isn’t an option or under special circumstances |

Direct rollover: This is the simplest and safest way to move your funds. You’ll contact your 403(b) plan administrator, let them know how much you want to roll over, and they’ll send a check directly to your Gold IRA account. The money never touches your hands, so there’s no risk of triggering taxes or penalties.

Indirect rollover: With this method, the plan administrator sends the check to you instead. From there, you have 60 days to deposit the full amount into your self-directed IRA. If you miss that window, the IRS treats it as a distribution, and that means taxes and possible penalties. There are more details and rules around this process, which you can find on the IRS website if you’re considering this option.

You don’t have to move all your funds into a self-directed IRA, but the IRS only allows one indirect rollover per year from a 403(b) to a Gold IRA without triggering taxes or penalties.

The rollover process

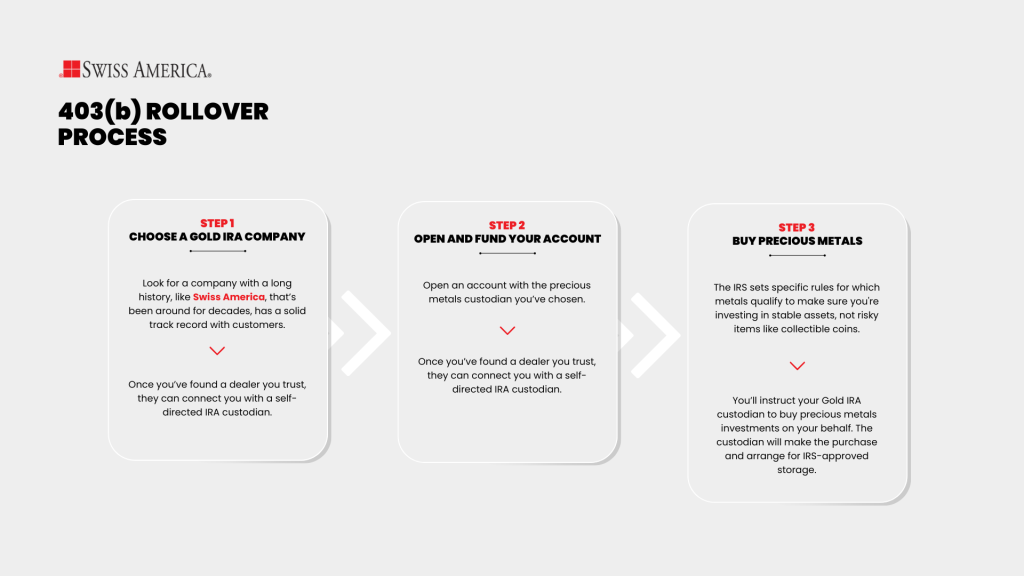

Step 1: Choose a Gold IRA company

Choose a reputable gold dealer. Look for a company with a long history, like Swiss America, that’s been around for decades, has a solid track record with customers, and provides educational resources to help you understand how a gold or precious metals IRA works.

Once you’ve found a dealer you trust, they can connect you with a self-directed IRA custodian. The custodian handles your retirement account, manages the funds, and takes care of buying and selling gold or other precious metals on your behalf.

Step 2: Open and fund your account

Open an account with the custodian you’ve chosen. Complete the application, submit your identification, and confirm the account details. Once everything is ready, contact your 403(b) plan administrator and instruct them to transfer your retirement funds directly to the custodian.

Step 3: Buy precious metals

Now that you’ve deposited funds into your account, you can choose which precious metals to buy. The IRS sets specific rules for which metals qualify to make sure you’re investing in stable assets, not risky items like collectible coins.

Approved metals meet purity standards and come from an accredited manufacturer or a government mint. You can invest in coins or bars in gold, silver, platinum, or palladium.

You’ll instruct your Gold IRA custodian to buy precious metals investments on your behalf. The custodian will make the purchase and arrange for IRS-approved storage at a third-party depository.

Which precious metals are IRS-approved?

We talked about buying IRA-approved metals. Here are the details of what qualifies:

Purity

Gold must be at least 99.5% pure. The other metals also have requirements, which include 99.9% for silver, 99.95% for platinum, and 99.95% for palladium.

Forms

Gold must be in bullion bars or coins, which are standardized forms of precious metals valued based on their metal content.

Manufacturer

Gold must come from a government mint or an accredited manufacturer. That’s why you’ll see specific gold coins or bars that qualify. Some of the most common qualified gold coins are the American Gold Eagle, Canadian Maple Gold Leaf, and the American Gold Buffalo. Popular bars include PAMPE Suisse, Royal Canadian Mint, and Credit Suisse.

Fees and costs associated with a Gold IRA

Like any investment, a gold IRA involves administrators and has some fees associated with this type of account. These fees include:

Premiums

When you buy gold coins, bars, or other precious metals, you’ll pay a premium above the spot price. This is standard in any retail setting and covers manufacturing, distribution, and dealer fees.

Custodian fees

Your Gold IRA custodian also charges fees to manage your retirement assets. These usually include a one-time setup fee, an annual maintenance fee, and storage fees through a third-party vault. We often recommend Gold Star Trust, and its fees for precious metals investing are:

- Setup: $50

- Annual maintenance: $90

- Commingled storage: $100

Gold IRA Fee Summary

| Fee type | Description |

| Account setup | One-time fee to set your account. |

| Annual maintenance fee | Recurring annual fee for account administration. |

| Segregated storage | Annual fee for storing your metals separately from others. |

| Non-segregated storage | Annual fee for storing your metals with other investors. |

| Buy, sell, exchange | Fee for buying, selling, or exchanging metals within your account. |

| Cashier’s check or wire transfer | Fees for funding logistics. |

| Various other fees like late fees, paper statements, termination fee, etc. | Various fees. |

Mistakes with 403(b) rollover to Gold IRA

There are some common mistakes to avoid when adding precious metals to your Individual Retirement Account. Getting these details right can save you time, money, and a lot of unnecessary stress down the road.

Not using a direct rollover

Whenever possible, it’s a good idea to use a direct rollover. It’s the cleanest and easiest way to move your funds without triggering taxes or penalties.

Some people go with an indirect rollover because they’re consolidating multiple retirement accounts or want a bit of flexibility during that 60-day window. But unless you have a specific reason, a direct rollover is almost always the smoother route.

Choosing a non-IRS-approved custodian

There are a lot of custodians out there, but you need to make sure you’re working with one that’s approved by the IRS to administer Gold IRAs. If you’re working with a reputable dealer like Swiss America, we’ll recommend the right kind of custodian for your needs.

That’s why you’ll want to choose a dealer with experience in physical Gold IRAs. We’ve been helping clients add precious metals to their retirement plans for decades, and can guide you through the rollover process from start to finish.

Failing to meet gold purity standards

This is another area where your Gold IRA provider can help guide you. You’ll want to make sure you’re only buying IRS-approved precious metals so everything you add to your retirement savings stays within the rules.

The last thing you want is to buy coins that don’t meet IRS standards and end up facing penalties or unexpected fees. We’ll help you avoid those missteps and make sure every piece fits the guidelines.

Storing gold at home

You can’t store precious metals from your Gold IRA at home. Instead, your custodian will arrange storage at an IRS-approved depository.

That’s actually an advantage. These facilities offer high-level security and include insurance to protect your gold coins or bars, giving you peace of mind while your assets stay safe and compliant.

Ignoring fees and costs

While the fees aren’t outrageous, you should understand what they are if you’re adding precious metals to your retirement plan. Ignoring the costs can leave you caught off guard when you look at your total investment.

Most custodians charge a one-time setup fee, an annual maintenance fee, and a separate fee for secure storage. These are usually pretty reasonable. Every custodian is different, though. Some may also charge fees for closing the account or for buying and selling gold inside the IRA. Be sure to ask about all potential costs upfront so you know exactly what to expect and can plan accordingly.

Over-allocating to Gold

Owning precious metals as part of your retirement savings gives you a way to protect your wealth and guard against risks like inflation or economic downturns. But you don’t want to put too much of your portfolio into gold.

Gold has its place, but it does come with some limitations. How much you add to your strategy really depends on your risk tolerance. It doesn’t produce income, and it doesn’t generate cash flow. Since it’s more of a defense mechanism, work with your financial advisor to set targets for how much you allocate.

Paper gold assets

Now you may be wondering how physical gold stacks up against other gold-related assets like mutual funds, mining stocks, or gold ETFs. While these paper assets do give you exposure to gold, they’re not the same as owning the real thing.

Each of these options depends on a third party to hold up their end. If you invest in a fund, the manager has to make wise decisions. If you own shares in a gold mining company, its operations have to run well. So your investment isn’t just tied to the price of gold but also to how those companies perform.

That’s why many people choose to add physical gold to their self-directed IRA. It gives you direct ownership without relying on someone else to manage the outcome.

Withdrawals from your Gold IRA

For selling or withdrawing precious metals inside your self-directed IRA, here’s what that process looks like:

Contact your self-directed Gold IRA custodian: Let them know you want to sell the gold or other precious metals in your account.

Choose a buyer: Reputable gold dealers like Swiss America offer a gold buyback program. You can request a quote from your dealer based on current market prices.

Authorize the sale: Once you’ve confirmed the details, you’ll authorize the sale and complete any forms required by your custodian.

Liquidation and funds: After the gold sells, the proceeds go back into your IRA as cash. The IRS doesn’t treat this as taxable income unless you take a distribution from the account.

Taking distributions: If you’re 59½ or older and want to withdraw the funds, you have two options. You can take a cash distribution, or you can take an in-kind distribution and receive the physical gold. Both options come with tax implications, so it’s a good idea to speak with a tax professional before making a move.

Swiss America for your 403(b) rollover

If you’re thinking about transferring funds from your 403(b) to purchase gold, it’s important to work with a dealer you can trust. Here’s why many investors choose Swiss America for their Gold IRA:

Decades of experience: We’ve been in the precious metals industry since 1982. We’ve seen the markets rise, fall, and everything in between. That perspective helps us guide you on how gold can support a stable and prosperous retirement.

Customer reviews: Like any major decision, it’s smart to take a look at what others have experienced. You’ll find that we’ve helped thousands of investors who are focused on building a secure financial future with gold and other precious metals. Their stories and feedback speak to their trust in us over the years.

Education: We’re very focused on helping investors understand why gold can provide a more secure financial future and how it compares to other investments. You’ll find helpful information in our weekday blog posts, regular podcast episodes, and in-depth resource guides.

Final thoughts on 403(b) Gold IRA

If you’re thinking about incorporating precious metals into your retirement savings and you’ve left your employer, rolling over your 403(b) can make a lot of sense. It’s a strong way to defend your wealth against inflation, stock market volatility, and whatever crisis comes next.

To learn more about setting up a Gold IRA, connect with the Swiss America team today!

403(b) Gold IRA rollover: FAQs

Can a 403(b) be rolled over into a rollover IRA?

Yes, you can roll over your 403(b) into a rollover IRA. You could keep it in stock market assets with a traditional IRA or use a self-directed IRA to invest in tangible assets like gold or real estate.

How do I convert my 403(b) to gold?

Start by choosing a Gold IRA company. They’ll help you open a self-directed IRA through an IRS-approved custodian. After that, you roll over your 403(b) funds, buy IRA-eligible gold, and the custodian stores it for you in a secure facility.

Is the free Gold IRA kit legit?

Yes, a free Gold IRA kit is legit. It’s a resource that helps you figure out if rolling your 403(b) into a Gold IRA makes sense for your financial situation.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.