There are 10 reasons to invest in gold right now to help offset the world’s uncertainty.

In our 40 years in the precious metals industry, we’ve seen this pattern repeat: when fear rises, investors turn to gold. Today, at $3,300 an ounce, interest is higher than ever.

Goldman Sachs recently stated, “It (gold) remains our preferred hedge against geopolitical and financial risks, with added support from imminent Fed rate cuts and ongoing EM central bank buying.” This article explains why.

Why invest in physical gold

Here are the reasons why gold is one of the best financial instruments you can own:

1. Inflation and currency protection

You don’t need to watch your savings lose buying power when prices rise. Gold protects against inflation because there’s only so much of it in the world, and no one can print more like they do with money.

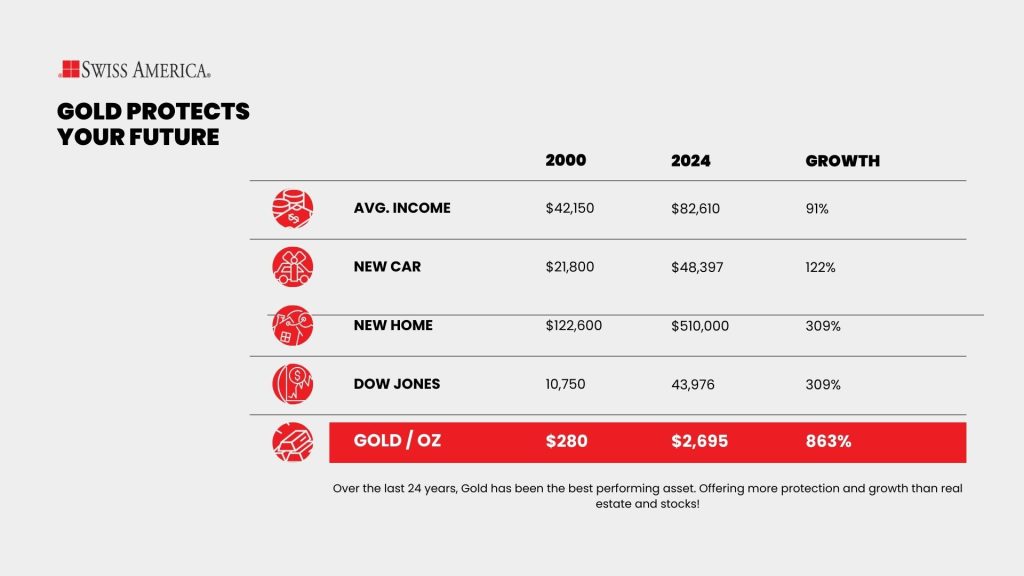

In the 1970s, when inflation hit over 14%, gold shot up by more than 1,700%. It started the decade around $35 per ounce and reached over $650 by 1980. Even compared to today’s benchmarks like income and the Dow Jones, gold’s 863% increase beat them all to help maintain purchasing power.

2. Wealth preservation

You don’t need to worry about gold depending on anyone else’s performance. Its value doesn’t rely on companies staying profitable or governments staying stable.

Physical gold also transfers easily through wills, trusts, or lifetime gifts. Many families gradually gift gold to younger generations, taking advantage of annual gift tax exclusions. With a Roth Gold IRA, you can even pass it on to your heirs tax-free.

The straightforward nature of physical gold means your inheritors can easily receive, understand, and manage what you leave them. No complicated paperwork or worrying about whether a company will still exist in 20 years.

3. Portfolio diversification

Gold doesn’t require a complicated strategy to spread your risk. Gold often moves in the opposite direction from stocks. So, when the market’s hot, gold prices dip because everyone’s chasing stocks instead. When the market tanks, people run to gold, pushing prices up.

While stocks still win long-term with returns, gold has beaten treasuries, commodities, and the dollar over time.

4. Safe-haven asset

Gold consistently performs whenever there’s a crisis because investors flee to safety. For example:

- 2008: During the Great Recession, gold prices increased by over 5% and kept rising.

- 2020: COVID hit, markets dropped, and gold reached all-time highs.

- 2025: Investors worry about inflation, tariffs, and the dollar’s value. Gold is now up over 37% from August 2024 to August 2025.

5. Tangible asset

You don’t need to worry about your investment disappearing if banks get hacked, financial institutions collapse, or the banking system fails. With physical gold assets, you control everything without relying on anyone else.

ETFs, gold stocks, and options mean you don’t actually own gold, and you’re at the mercy of fund managers. If these companies face problems, your investment exists only on paper. Physical gold gives you direct ownership of a tangible asset that functions independently of digital systems.

6. Historical store of wealth

Gold has maintained its worth for centuries because of limited supply and growing demand from central banks, investors, and jewelry buyers.

During the past few years, central banks purchased more gold than ever before, driving prices to new highs. When the world’s financial institutions are stockpiling it, that tells you something about its long-term value.

7. Global liquidity

When you are ready, it is easy to sell gold. Unlike some investments where you might struggle to find interested parties, gold has a massive global market that’s been around for thousands of years.

Any reputable precious metals dealer can give you a quote to buy back your gold bars or coins.

8. Privacy and protection from digital risks

Physical gold can’t be hacked, stolen with a click, or erased from a server. While banks and financial firms face cyber-attacks that account for one-fifth of all digital threats, your gold sits safely outside the digital world.

You can also buy gold coins or bars privately without leaving a digital footprint, giving you financial freedom in an increasingly monitored world.

This makes gold immune to risks like cyberattacks, hacking, or government-imposed freezes on assets.

9. No counterparty or bankruptcy risk

When companies fail, your gold doesn’t disappear with them. Physical gold has independent value that survives institutional collapses.

When Silicon Valley Bank collapsed in 2023, customers couldn’t access their money for days. When FTX went bankrupt, customers lost billions because they trusted a company to hold their assets.

When you hold gold, you’re not waiting for anyone to access your wealth, and it has value regardless of what happens in the financial system.

10. Portable wealth

As of this writing, 1 ounce of gold is worth $3,378. It’s easy for a small amount of gold coins or bars to hold significant financial value in a compact space. For example, a 10-oz gold bar is about the size of a cell phone, which means you can easily carry gold worth over $33,000 in your pocket if you need to take your wealth with you.

This makes gold one of the most portable forms of wealth available.

As for the current spot pricing, we think gold will go even higher. We even shared how gold might hit $4,000 an ounce on our YouTube channel:

Here’s a summary showing the main advantages of investing in gold at a glance:

| Benefit | What it means | Primary advantage | Example/Context |

|---|---|---|---|

| Inflation & currency protection | Gold holds value when money loses buying power | Helps preserve purchasing power | Inflation periods often see rising gold prices |

| Wealth preservation | Long-term value retention | Protects wealth across generations | Gold can be passed via trusts or gifts |

| Portfolio diversification | Asset not tied to stocks/bonds | Reduces overall portfolio risk | Often moves independently from equities |

| Safe haven & global liquidity | Performs during crises and is easy to sell | Offers security and exit options | Demand rises in recessions and uncertainty |

Choosing a precious metal dealer

If you’re looking to add precious metals to your investment portfolio, here’s why investors choose Swiss America as their precious metal dealer:

- Decades of experience: With over 40 years in the industry, Swiss America has been through many economic ups and downs. We can share what others have done to combat rising inflation or worries about the stock market.

- Client satisfaction: Check out our customer testimonials and reviews.

- Professional guidance: Our team can help explain how to buy gold, provide recommendations for storage, and help you balance gold with your other investments.

Why to invest in gold

While we provided 10 reasons people commonly see gold as a good investment, there may be others that make sense for your situation. The best way to find out is to contact us today and find out if adding gold to your portfolio is a good fit for your overall needs.

10 reasons to invest in gold: FAQ

Should I turn my cash into gold?

The answer depends on your financial goals. Gold can protect against inflation and economic uncertainty and most investors look at this asset as a way to diversify their portfolio.

Is it wise to invest in gold funds?

Yes, you can invest in gold funds. You might want to do this to gain exposure to gold without needing to store physical metal. But since these are paper traditional assets, they don’t give you any of the benefits of physical gold.

Should beginners invest in gold?

Yes, beginners can invest in gold to diversify their portfolios and protect against inflation.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.